Thrivent retirement calculator

Get a personalized plan for retirement and other goals delivered by a financial advisor. For 2022 the maximum annual IRA.

How To Use A Roth Ira Calculator Ready To Roth

This calculator provides an easy way to start.

. The amount you will contribute to your Roth IRA each year. The ActivePlus Portfolios Program. A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today.

From 1925 through 2021 the CPI has a long-term average of 29 annually. Value can grow at a competitive. Ad Everything You Need to Know About Planning for Your Retirement.

Over the last 40 years the highest CPI recorded was 135 in 1980. But even then the 15 rule of thumb assumes that you begin saving early. Get a model portfolio.

For instance if a. Ad Get Personalized Action Items on What Your Financial Future Might Look Like. This calculator assumes that you make your contribution at the beginning of each year.

Thrivent Mutual Funds also offers SIMPLE IRAs 403 b accounts and more. Retirement income planning calculator The retirement income planning calculator provides an easy way to start planning for. Try Our Calculator Today.

Retirement calculator Retirement solutions for a range of needs Kick-start. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Start Today With Our Free Easy to Use Online Chat.

Many financial advisors recommend a similar rate for retirement planning purposes. Our Balanced Homebuying recommendation is the amount weve calculated for you to spend on a home. This calculator helps you find out.

Build Your Future With a Firm that has 85 Years of Investment Experience. 1 Distributions of earnings are tax-free as long as its. To speak with a representative regarding your account contact us Monday - Friday between 5 am.

Ad This guide may help you avoid regret from certain financial decisions with 500000. In the retirement calculators graph it shows your annual withdrawal as a dollar amount but you also may see it expressed as a percentage of your total savings in other. A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today.

Build Your Future With a Firm that has 85 Years of Investment Experience. Thrivent opened membership to non-Lutheran Christians in 2014. Of course of all the.

Planning for Retirement and Benefits Made Easier With The AARP Retirement Calculator. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Enter information about your age and expectations.

They can guarantee income in retirement for as long as you live. Thrivent Mutual Funds fees. The organization used to sell several types of annuities but it now appears to sell only variable annuities.

Annual IRA custodial fee is 15 per shareholder Traditional SEP and Roth IRAs combined. Annuities combine insurance and savings into one really useful financial product. Contact your Thrivent financial advisor.

If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid. How its calculated RMD is calculated by dividing the account value adjusted for any outstanding transfers rollovers and recharacterizations divided by a life expectancy factor. People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle.

Pacific time and Saturdays between 6 am. Make sure your mortgage leaves room for living saving and giving. Fee may be waived if you have 50000 or more invested in Thrivent.

Prepare For Your Future Today. Enter the specifics about your current mortgage along with your current appraised value. How much interest can you save if you refinance your mortgage.

Our retirement savings calculator predicts your total retirement savings in todays amount then highlights how that amount might expand over the years you plan to spend in. For information a Thrivent financial professional can help. You can enter your monthly income from the noncovered pension your earnings from each year of your Social Security record and the income you expect to earn in the future.

For 2021 the last full year available the CPI was.

News From Byron Hamm Thrivent

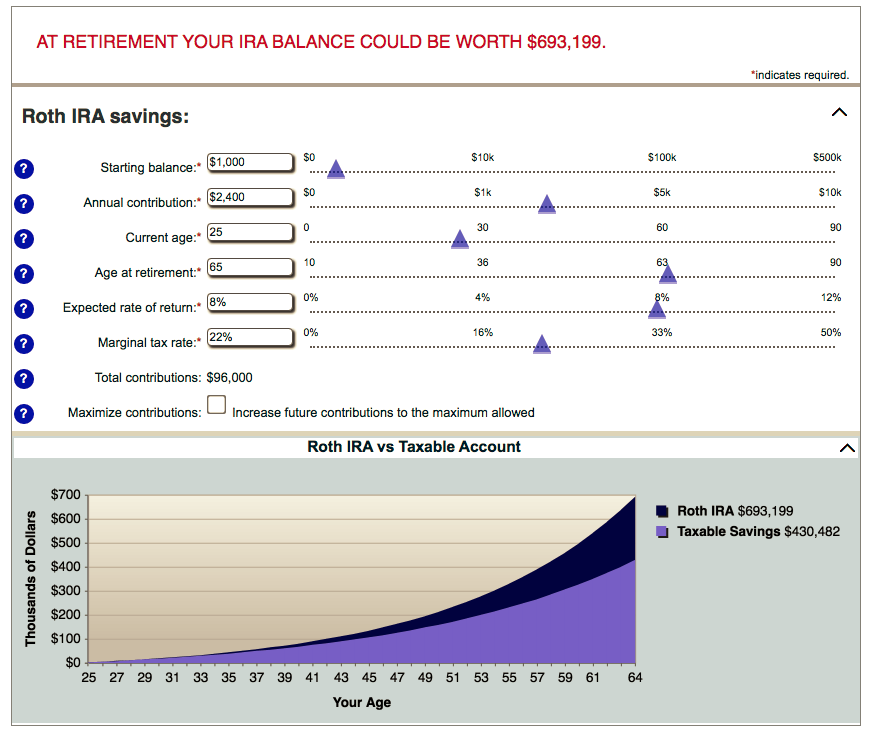

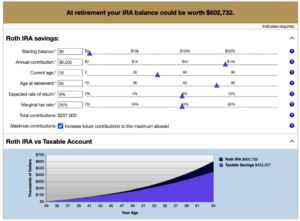

Roth Ira Calculator 2022 Thrivent

What Is The Best Roth Ira Calculator District Capital Management

How To Avoid Running Out Of Money In Retirement Thrivent

All Calculators Intentgen

Thrivent Benefits Comparably

How Much Do I Need To Retire Thrivent

What Is The Best Roth Ira Calculator District Capital Management

Thrivent Myga 10 Earn 3 60

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Plan For Retirement With Iras Thrivent Credit Union

Thrivent Employee Benefit Pension Plan Glassdoor

Shanell Foster Mba Shanellfoster05 Twitter

What Is The Best Roth Ira Calculator District Capital Management

Plan For Retirement Thrivent

Thrivent Financial Long Term Care Insurance Review Ltc News